Area Add-Up Insurance Performance: Insights from Cotton STAX

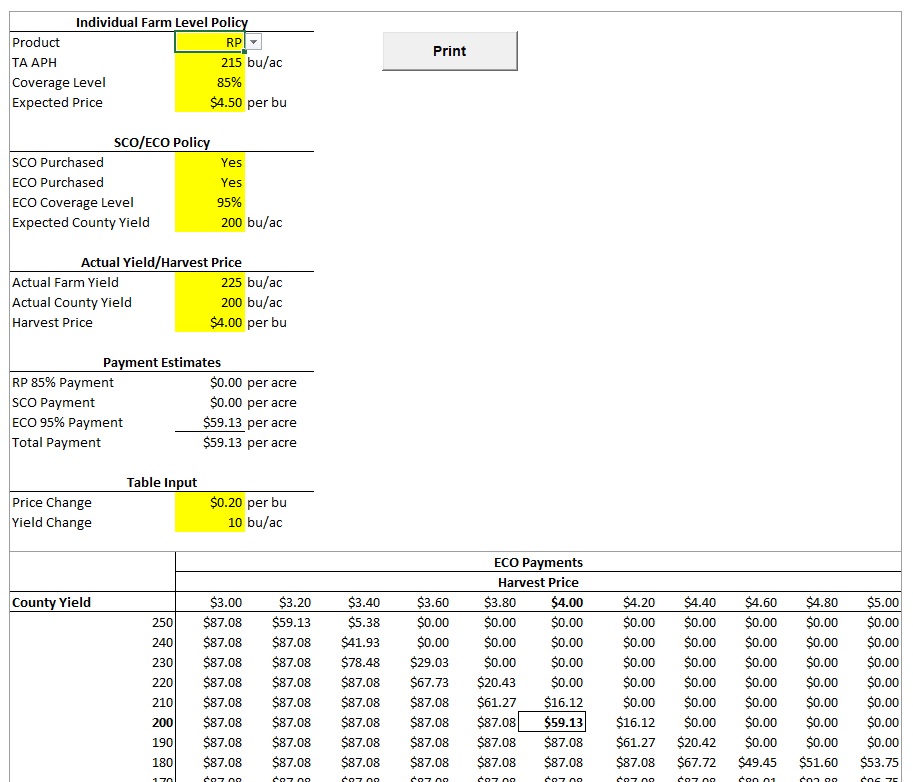

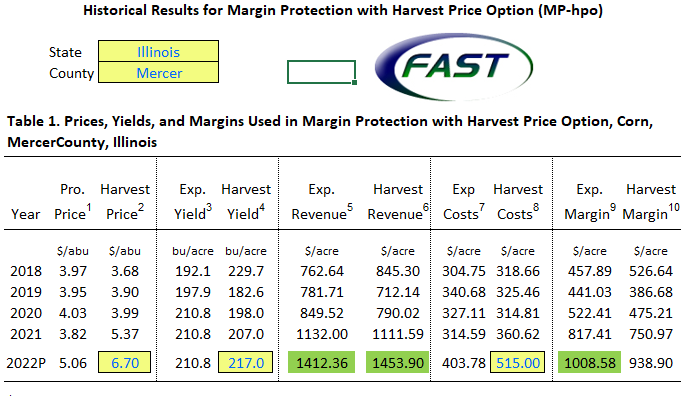

Starting with crops harvested in 2026, premium subsidy for ECO and SCO area add-up insurance will be 80%. Coverage options are 90% or 95% for ECO and 90% for SCO. STAX area add-up insurance has offered 90% coverage – 80% subsidy for cotton since 2015. Ratio of indemnities net of farmer paid premiums to farmer paid premiums has been notably higher for STAX than individual farm insurance, especially when insurance price declined double digits. Performance should be similar for ECO and SCO.

Circumventing the Federal Budget Process: Crop Insurance Premium Subsidies

Over the last two years, Federal crop insurance premium subsidies have been raised far more by procedures outside the Farm Bill than inside the Farm Bill. Two USDA administrative actions raised the premium subsidy rate for ECO insurance to 80%. They conservatively are estimated to raise Federal premium subsidies by $13.2 billion over 10 FYs. This case study illustrates how the Federal budget process can be circumvented, calling into question its fiscal integrity and usefulness.

Monetizing Crop Risk into Crop Payments

US federally subsidized crop insurance has monetized field crop production risk into a multi-billion dollar income flow to farmers. Monetized value has grown with higher market value of production, higher premium subsidies, higher coverage levels, and, recently, higher use of area add-up insurance. Monetization will continue as the 2025 Farm Bill has raised premium subsidies for nearly all insurance products including an 80% subsidy for 95% coverage ECO area add-up insurance.

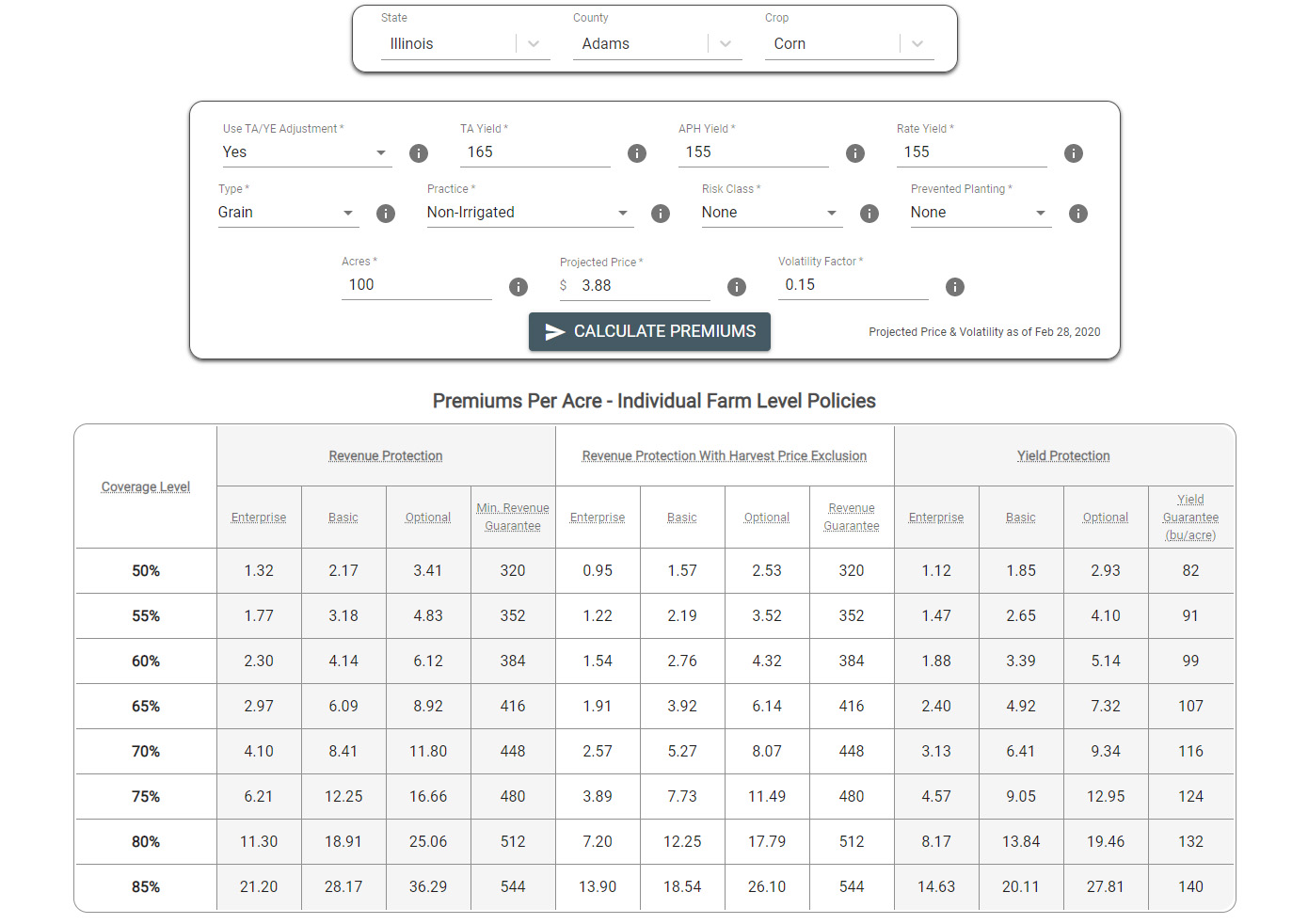

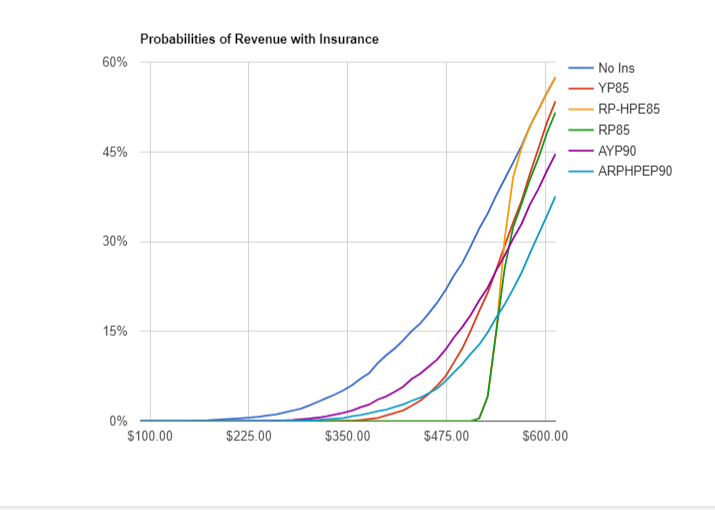

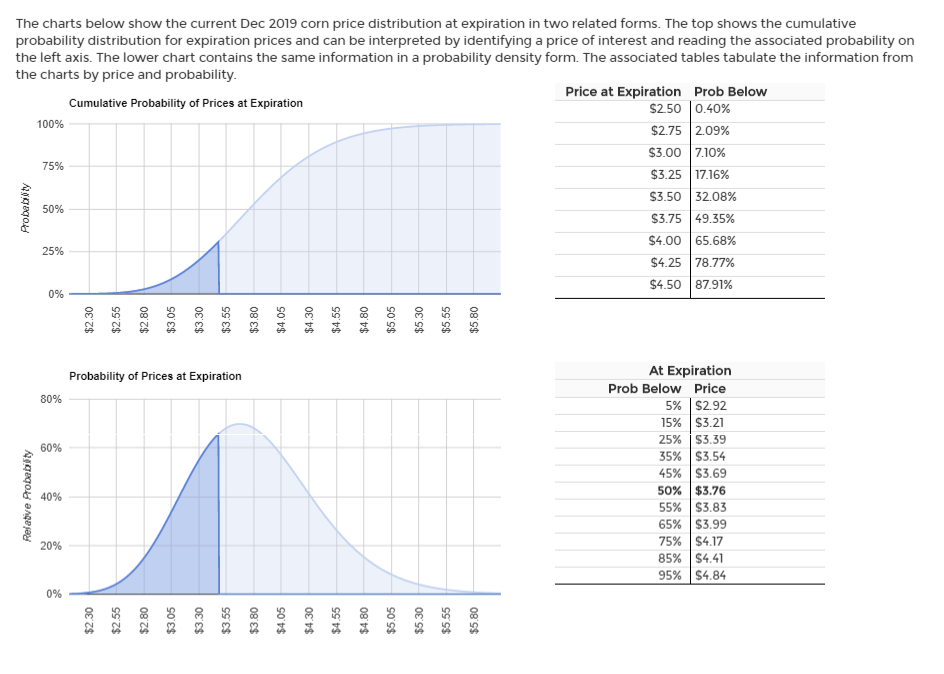

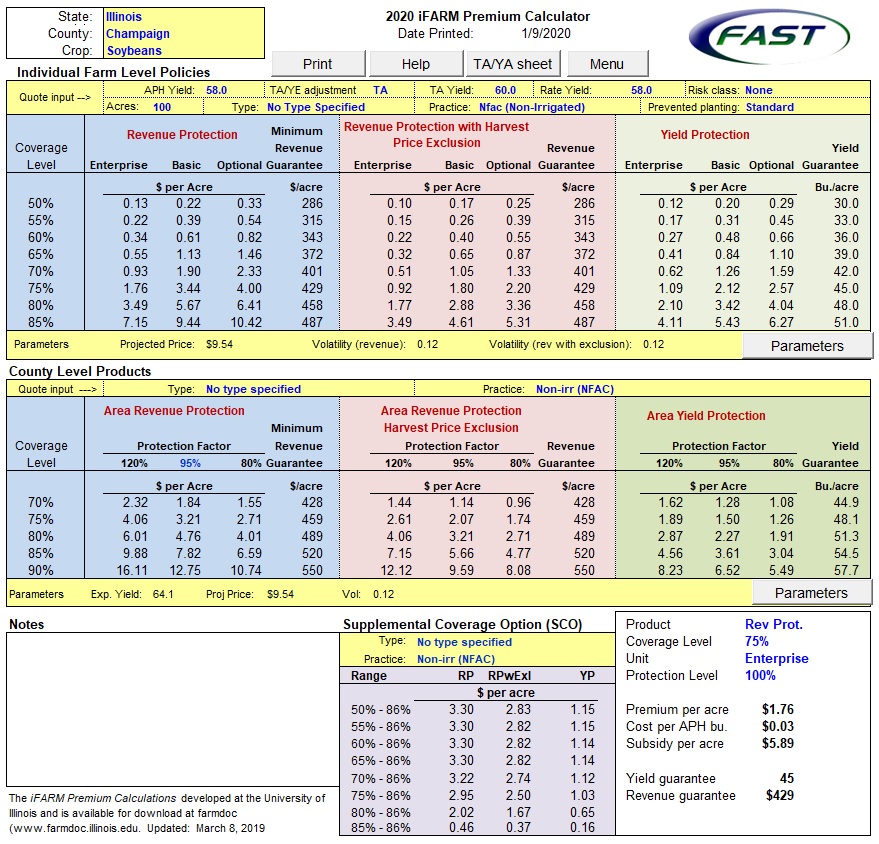

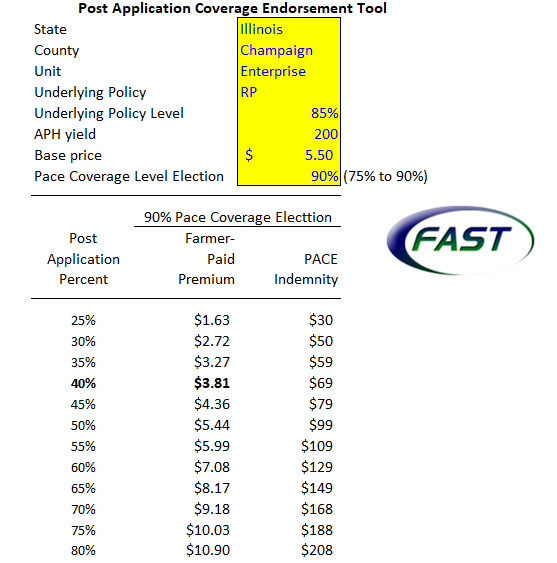

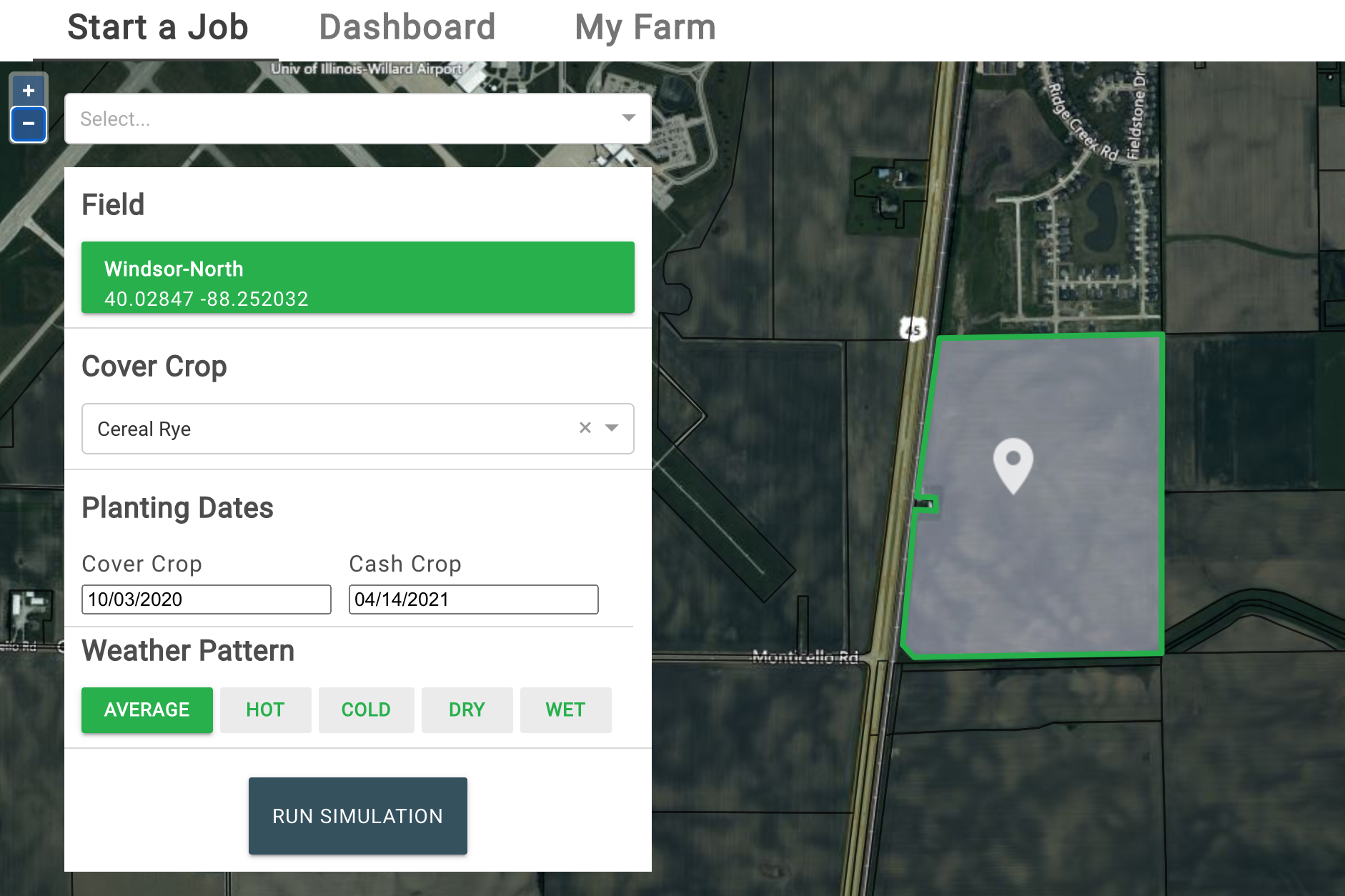

The farmdoc Crop Insurance section offers iFARM online tools including the Premium Calculator, Payment Evaluator and Price Distribution Tool. These tools are updated annually during the Spring crop insurance election period.